If you’re investing in Florida real estate, DSCR loans might be on your radar.

These loans require you to focus solely on your property’s income to qualify for financing, which is crucial in a diverse market like Florida.

This article breaks down the essentials of DSCR loans in Florida, helping you decide if they align with your investment needs, without requiring traditional income documentation.

Key Takeaways

- DSCR loans in Florida prioritize the rental property’s income generation over personal income, offering flexibility for real estate investors by using the property’s Debt Service Coverage Ratio to assess loan eligibility.

- The viability of securing a DSCR loan for an investment property in Florida is highly dependent on the property’s Net Operating Income, local economic factors, and prevailing interest rates which affect the property’s DSCR.

- For real estate investors in Florida, DSCR loans offer advantages such as no traditional employment and income verification, but come with potential drawbacks like higher interest rates and certain property eligibility restrictions.

Demystifying DSCR Loans in Florida

DSCR loans in Florida are an alternative to traditional home loans designed specifically for real estate investors, emphasizing the property’s ability to generate income for loan approval. A Florida DSCR loan is gaining popularity due to its flexibility and focus on the property’s income potential, which is an advantage for real estate investors.

The Basics of DSCR Loans

A DSCR loan is a mortgage loan based on the net operating income (NOI) of the rental property, specifically designed to provide financial flexibility for real estate investment. DSCR, which stands for Debt Service Coverage Ratio, focuses primarily on the income potential of the investment property, ensuring a smooth loan repayment process.

The streamlined financing process of DSCR loans is realized by evaluating the property’s expected rental income compared to its debt obligations. For investors, DSCR loans are advantageous as they prioritize property income over personal income, expanding opportunities to secure funding without providing traditional income verification documents.

Florida’s Unique Real Estate Landscape

Florida’s real estate market is characterized by its diversity, offering everything from luxury waterfront properties to budget-friendly homes, with numerous property types eligible for DSCR loans. DSCR loans are particularly suitable for Florida’s market due to the variety of residential properties available for business purposes, including Florida rental property options.

Investment opportunities abound in various locales within the state, attracting a diverse range of real estate investors. With the state’s unique investment landscape, DSCR loans serve as a flexible and attractive financing option, allowing investors to tap into the full potential of Florida’s booming real estate market.

Evaluating Your Investment Property through DSCR

The Debt Service Coverage Ratio (DSCR) measures an investment property’s capacity to service debt with its income, focusing on property-level cash flow rather than personal income which is crucial for evaluating investment potential.

Calculating DSCR for Your Florida Property

DSCR is calculated by dividing the property’s annual Net Operating Income (NOI) by its annual mortgage debt service, specifically PITIA (principal, interest, taxes, insurance, and association dues) for rental properties. In Florida, the formula for calculating the Debt Service Coverage Ratio (DSCR) for commercial or multi-family properties is to divide the Net Operating Income by the Annual Debt Service. This ratio is used by lenders to assess the property’s ability to cover its debt obligations..

A DSCR of 1.0 indicates that the borrower can cover monthly payments using rental income, while a DSCR of 1.25 is typically the minimum required by lenders for securing a loan. The income generated by the property, rather than the borrower’s personal financial history, is prioritized to determine loan eligibility.

Factors Affecting DSCR in Florida

Areas like Jacksonville, known for its affordable housing market, growing economy, and expanding job market, as well as Orlando with high demand for short-term rentals and growing job opportunities, significantly affect the rental demand, enhancing the viability of investment properties for DSCR loans.

Rising interest rates result in higher borrowing costs, leading to reduced net operating income and a lower DSCR, whereas falling interest rates can have the opposite effect, potentially improving an investor’s DSCR.

The local property taxes structure, along with anticipated changes, can have a substantial impact on a property’s income potential or property values, subsequently affecting the DSCR for Florida-based investment properties.

Fluctuations in the real estate market can lead to changes in the DSCR ratio, influencing whether or not an investment property will meet the requirements for securing financing through a DSCR loan in Florida.

Securing a DSCR Loan in Florida: Steps and Requirements

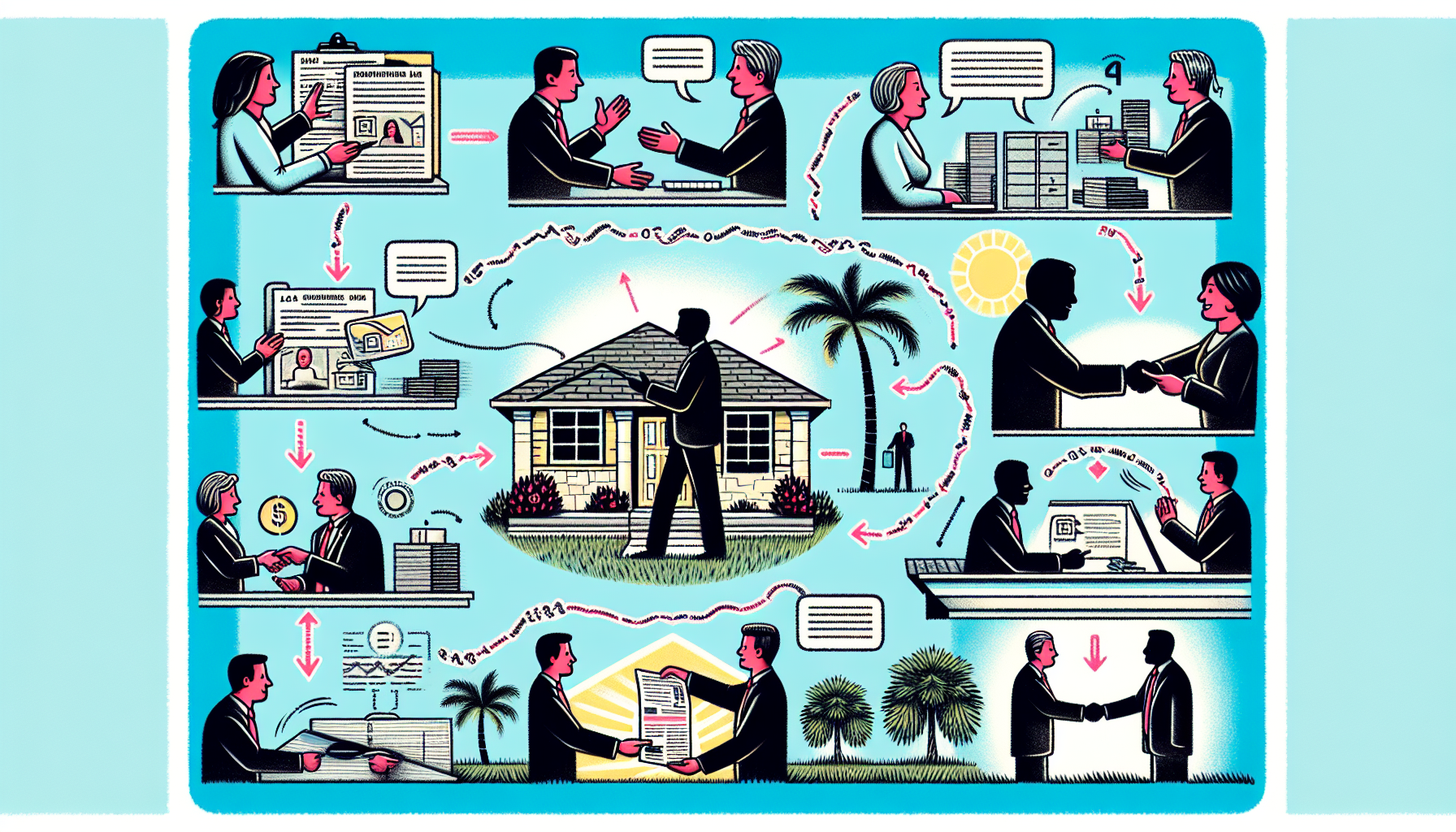

Securing a DSCR loan in Florida involves the following steps:

- Meeting a minimum DSCR requirement ratio

- Presenting historical financial statements and future projections

- Providing a property or business appraisal

- Providing proof of creditworthiness

Credit Score and Financial History

Lenders typically require a minimum FICO Score for pre-qualification of DSCR loans in Florida. A borrower’s credit score can affect the interest rate they receive and their qualifying leverage for a DSCR loan.

DSCR loans in Florida are qualified based on the property’s rental income versus its debt obligation, bypassing the need for proof of borrower’s income or employment history. Investors are generally required to provide a down payment of at least 20% when applying for DSCR loans.

Property Evaluation and Appraisal

An appraisal of the property is a necessary component of the DSCR loan application process in Florida. The process of obtaining a DSCR loan involves several steps including:

- Property appraisal

- Loan approval

- Signing of final documents

- Funding the loan

Properties such as single-family residences or multifamily apartment buildings are commonly purchased using DSCR loans in Florida. Hence, a thorough and accurate property evaluation and appraisal play a vital role in the DSCR loan application process.

Navigating the DSCR Loan Application Process in Florida

Initiating a DSCR loan application in Florida typically involves an initial conversation with the lender, which can be conducted through a virtual meeting or phone call, and is followed by going through the formal loan application process.

Finding the Right Lender

Griffin Funding serves real estate investors throughout Florida by offering a variety of non-QM loan options for flexible financing, including DSCR loans. Vaster provides tailored Florida DSCR loans that cater to the unique needs of each real estate investor, ensuring a customized financing solution.

District Lending takes an approach that compares different lenders on behalf of their clients to secure not only the best rates but also a superior borrowing experience for DSCR loans in Florida. Having the right lender can significantly influence the success of your DSCR loan application.

Preparing Your Loan Application

A down payment typically as low as 20% is required when applying for a DSCR loan in Florida. Applicants must meet a minimum credit score requirement to qualify for a DSCR loan, though the specific score required is not detailed.

Preparing your DSCR loan application involves understanding the criteria, ensuring you meet the requirements, and presenting a comprehensive application that underscores your investment’s potential.

Pros and Cons of DSCR Loans for Florida Real Estate Investors

DSCR loans offer several advantages but they also come with potential drawbacks. Understanding these can help real estate investors make informed decisions.

Benefits of DSCR Loans

DSCR loans offer a simplified application process by not requiring traditional employment and income verification, catering to a broader range of investors. Qualification for DSCR loans centers on the property’s revenue-generating potential, defined by its cash flow, rather than the personal income of the borrower.

Investors benefit from the ability to engage in unrestricted portfolio development and leverage options for cashout refinancing, enhancing their investment strategy flexibility. DSCR loans offer adjustable loan structures including interest-only payment options and serve both novice and experienced investors, offering financial maneuverability.

Drawbacks of DSCR Loans

Stricter lending standards can make it more difficult for investors to qualify for DSCR loans, affecting their ability to access financing. DSCR loans typically come with interest rates that are approximately 1% to 3% higher than those of Fannie Mae backed loans for investment properties.

While DSCR loans offer quick approval times and various repayment options, they come with higher interest rates and property eligibility restrictions, making them a nuanced choice for Florida investors. Therefore, the pros and cons of DSCR loans should guide Florida real estate investors to carefully consider their investment goals and the financial viability of their projects when considering this financing option.

Case Studies: Success Stories with DSCR Loans in Florida

Florida’s varied real estate investment landscape has seen numerous success stories with the use of DSCR loans, with investors leveraging these loans for both residential and commercial properties.

Residential Investment Properties

Florida investors commonly use bridge loans for the initial acquisition and rehabilitation of residential investment properties. Following the use of bridge loans, investors often refinance with DSCR loans to secure long-term financing solutions.

A case study reveals that this two-step financing strategy has been successful for residential property investments in Florida. Refinancing with a DSCR loan affords investors the opportunity for stable, long-term investment success, leveraging the property’s income to cover debt obligations.

Commercial Investment Properties

A case study highlighted how a real estate investor successfully acquired a high-demand commercial property in Lakeland, Florida and an industrial warehouse located in a logistics hub. The DSCR loan used by Wendy S. to purchase the off-market property came with an interest rate range of 7.5 to 8.5% and required a 25% down payment.

Post-financing outcomes included:

- Leveraging a bridge loan for property rehabilitation

- Refinancing with a DSCR loan for cash flow optimization

- Attracting high-quality tenants

- Securing long-term leases

This example showcases how Florida’s commercial real estate investors can strategically utilize DSCR loans to achieve a positive cash flow and use it to their advantage.

Summary

DSCR loans in Florida offer a flexible and pragmatic alternative for real estate investors, allowing them to leverage the income potential of properties, thereby bypassing traditional financing restrictions. Despite their advantages, these loans come with drawbacks, such as higher interest rates and property eligibility restrictions, which investors should carefully consider. The varied real estate landscape of Florida presents numerous opportunities for the successful application of DSCR loans, as demonstrated by the case studies. In an ever-evolving real estate market, DSCR loans stand out as a strategic financing tool for savvy investors.

Frequently Asked Questions

What is a DSCR loan?

A DSCR loan is a type of mortgage loan that considers the net operating income of a rental property to provide financial flexibility for real estate investment.

How is DSCR calculated?

To calculate DSCR, you simply divide the property’s annual Net Operating Income (NOI) by its annual mortgage debt service. This helps to determine the property’s ability to cover its debt obligations.

What factors affect DSCR in Florida?

In Florida, rental demand, interest rates, local tax structure, and real estate market fluctuations are the key factors that influence DSCR. These factors can significantly impact the debt service coverage ratio for properties in the state.

What are the requirements for securing a DSCR loan in Florida?

To secure a DSCR loan in Florida, you need to meet a minimum DSCR requirement ratio, submit historical financial statements and future projections, provide a property or business appraisal, and demonstrate creditworthiness. These are the key requirements for obtaining a DSCR loan in Florida.

What are the benefits and drawbacks of DSCR loans?

DSCR loans offer a simplified application process and flexibility for investors, but they come with stricter lending standards and higher interest rates. Consider these factors when deciding if this type of loan is right for you. They are a great choice if you need to finance multiple properties and your DTI doesn’t allow you to qualify using traditional loans.

Ready for More Great Tips and Information? Join Our Email List Today!

Leave a Reply