Seeking a DSCR loan in Oregon for your investment property?

Quickly learn how to get DSCR loan Oregon, as we guide you on how to qualify and apply for financing that focuses on your property’s income, not your personal credit.

In this article, navigate the straightforward path to obtaining a DSCR loan, tailor-made for Oregon’s real estate investors.

Key Takeaways

- DSCR loans in Oregon offer an alternative real estate investment financing option focusing on property cash flow rather than personal income, suitable for various investor profiles and properties.

- Key preparation steps for obtaining a DSCR Loan include assessing investment property potential, understanding lender requirements, and gathering necessary documentation such as bank statements, credit reports, and property appraisals.

- Managing a DSCR loan effectively is crucial, encompassing monitoring property cash flow to maintain a DSCR above 1.00 and considering refinancing options to improve loan terms and increase investment returns.

Understanding DSCR Loans in Oregon

Navigating the financial landscape of real estate investment can be complex, especially in the vibrant Oregon market. For investors seeking flexibility and a focus on property income, DSCR loans in Oregon present a compelling option. Tailored to prioritize the cash flow generated by your investment over personal financial history, these loans open doors for a wide array of investors, from the self-employed to seasoned portfolio builders.

Whether you’re looking to finance a single-family residence or a multi-unit property, understanding the nature of DSCR loans can be a game-changer.

The Basics of DSCR Loans

A DSCR loan, or Debt Service Coverage Ratio loan, is a type of loan where the lender considers the borrower’s ability to repay the loan based on their income and existing debt obligations. It is calculated by dividing the property’s net operating income by its debt service. At its core, the debt service coverage ratio (DSCR) is a financial metric lenders use to ensure an investment property will generate enough income to cover its debt payments.

When you apply for a DSCR loan in Oregon, lenders will divide the property’s gross rental income by its total housing payment, which includes:

- Principal

- Interest

- Property taxes

- Insurance

- HOA dues (if applicable)

For your property to pass muster, it should showcase a DSCR ratio of at least 1.2, signifying that it can comfortably handle the loan payments and operational costs.

Key Benefits of DSCR Loans

Now, why might a DSCR loan be the financing tool of choice for your Oregon investment property? One of the key advantages is the loan’s focus on your property’s cash flow rather than your personal income, which can simplify the borrowing process if you have irregular or self-employed income. Additionally, DSCR loans offer the following benefits:

- They reduce personal financial exposure, as the loan is secured against the property’s income.

- They provide a higher loan-to-value ratio compared to traditional loans.

- They offer flexible repayment terms and options.

- They can be used for various types of investment properties, including residential, commercial, and multi-family properties.

Related: DSCR Loan Vs. Conventional Loans

Consider these advantages when deciding on the financing option for your Oregon investment property.

The flexibility of hard money loans doesn’t end there; these loans can accommodate various ownership structures, including partnerships and LLCs, and they typically close faster than traditional financing options, allowing you to seize opportunities in the dynamic Oregon market more swiftly. With the availability of various loan programs, such as hard money loans, borrowers have more options to choose from.

Preparing for Your DSCR Loan Application

Before you embark on the application journey, it’s crucial to prepare diligently. The uses of DSCR loans are manifold, including:

- purchasing

- financing rentals

- flips

- cash-out refinances

Your preparation strategy will vary depending on the loan’s intended use, but a thorough understanding of your investment property’s income potential, lender requirements, and necessary documentation is indispensable, especially when considering a no income loan.

Assessing Your Investment Property

When it comes to your investment property, lenders will scrutinize its income potential. They often use the lower of the current rent or market rent determined by an appraisal to calculate your DSCR ratio. Whether your investment is a single-family home, duplex, or mixed-use property, its ability to generate ample rental income is key.

Moreover, the Oregon rental market must exhibit sufficient demand to support your property’s gross rental income, a major criterion for DSCR loan approval. Focusing on properties ideal for renting or commercial activities, the income potential becomes a focal point for securing a DSCR loan in Oregon.

Understanding Lender Requirements

Lender requirements for DSCR loans in Oregon are typically straightforward but essential to comprehend. Most lenders look for a minimum credit score, often around 680, although some programs may accept scores as low as 600. A minimum down payment, usually 20%, is also required, ensuring you have a significant equity stake in the property.

The appraisal process delves into the investment property’s income potential, specifically its projected rental income. While DSCR loans focus on the property’s cash flow, lenders in Oregon do not overlook borrower factors such as credit scores and cash reserves.

Gathering Necessary Documentation

Assembling the necessary financial documents is a crucial step in the application process. You’ll need to provide:

- Bank statements

- Credit reports

- Proof of cash for down payments and reserves

- Property appraisals

- Lease agreements

For rental properties, especially long term rentals, detailed documentation of rental agreements and income statements is vital.

If you’re applying for a fix and flip loan, be prepared to submit the purchase contract, documented estimates of repair costs, and the projected sale price of the property. The documentation required may seem daunting, but consulting with a mortgage expert in Oregon can provide clarity and specific advice tailored to your DSCR loan needs.

Choosing the Right DSCR Lender in Oregon

Once you’ve got your ducks in a row, it’s time to choose a DSCR lender that aligns with your investment goals and understands the nuances of the Oregon market. The right lender should not only offer competitive rates and terms but also provide tailored solutions that reflect the characteristics of your investment property.

Comparing Lender Rates and Terms

Interest rates for investment properties can be influenced by a host of factors from the borrower’s credit score to the type of property involved. In Oregon, rental property loan rates, including mortgage loan rates, currently range from 6.99% to 9.99%. It’s not uncommon for lenders to offer lower rates in exchange for accepting prepayment penalties, which could hinder your ability to refinance in the early years of the loan.

Researching lenders like Griffin Funding, which offers competitive rates in Oregon cities such as Portland, Eugene, and Bend, can yield favorable terms for your investment.

Evaluating Lender Expertise and Reputation

In-depth knowledge of loan products and a solid reputation for proactive communication are hallmarks of lender expertise in DSCR loans. A lender’s ability to tailor loan scenarios to Oregon’s unique market conditions can be a significant advantage, so look for those who understand local real estate trends and offer flexible requirements, like the absence of a seasoning period before refinancing.

Applying for Your DSCR Loan in Oregon

Now comes the moment of truth: applying for your DSCR loan in Oregon. This involves a detailed loan application and a navigation through the approval process. With a lender like Easy Street Capital, the process can be swift, taking approximately 1-2 business days.

Completing the Loan Application

Accuracy is key when completing your DSCR loan application. You’ll need to provide detailed information about the property, including its address, purchase price, and current value estimate. If you’re financing a rental, include rental history; for fix and flip projects, details about the flip are necessary. An application filled with precision can lead to a smoother review process and a successful loan outcome.

Navigating the Approval Process

The approval process can take anywhere from 30 to 45 days but can be expedited with prompt documentation and appraisals. Lenders will perform thorough appraisals and rental market analyses to ensure that the demand supports the property’s projected gross rental income.

The streamlined process of DSCR loans enables investors to quickly engage with the Oregon real estate market and capitalize on investment opportunities.

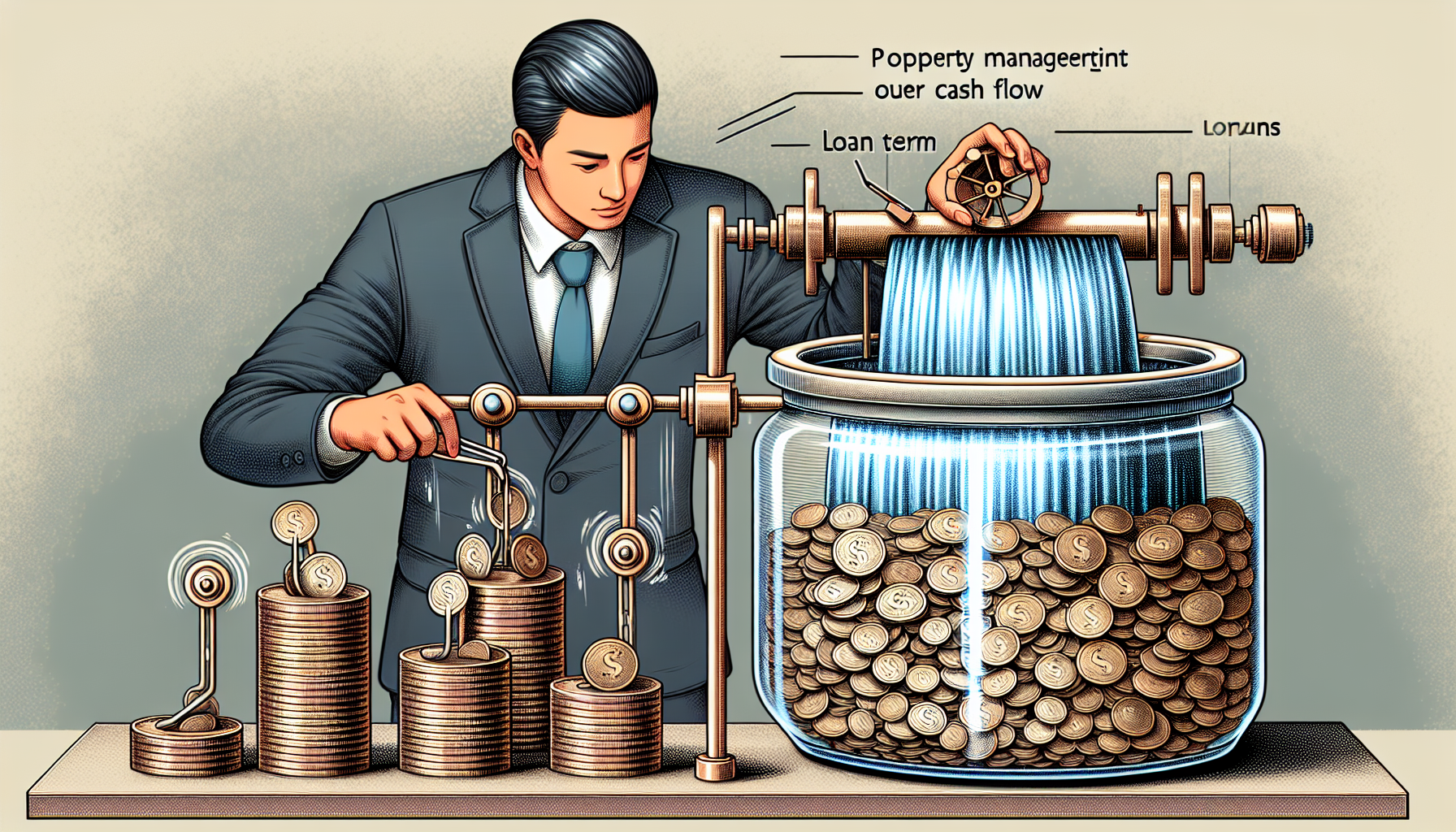

Managing Your DSCR Loan

Once your DSCR loan is in place, managing it effectively becomes your top priority. This includes keeping a close eye on your property’s cash flow and being vigilant about loan terms to avoid default since the loan is predicated on property revenues over personal income.

Monitoring Property Cash Flow

Maintaining a DSCR above 1.00 is imperative as it indicates that the property’s income is ample to cover expenses and debt service. Interest-only payment options may be available for part of the loan term, which can augment an investor’s cash flow.

Ensuring that the cash flow is adequate to sustain a healthy DSCR is a sign of sound financial management and investment stability.

Refinancing Options

Refinancing your DSCR loan can come with several benefits, such as achieving a lower interest rate, increasing cash flow, or changing financing terms. Lower rates can reduce your monthly interest expenses and elevate your DSCR. Extending the loan term can result in lower monthly payments, potentially giving you greater financial flexibility.

A cash-out refinance could be particularly advantageous for those following the BRRR investment strategy, allowing access to property equity.

Case Studies: Successful DSCR Loan Borrowers in Oregon

The proof is in the pudding, as they say, and Oregon’s rental property market is ripe with success stories of real estate investors who have leveraged DSCR loans effectively in their real estate investments. Single-family residential properties, for instance, offer a broad tenant base and potential for long-term appreciation.

The increasing arrival of young professionals and retirees in Oregon has stoked the demand for rental units, making DSCR loans an attractive tool for acquiring both urban apartments and rural homes.

Summary

From understanding the fundamentals of DSCR loans to witnessing success stories in the thriving Oregon market, this guide has covered the essential steps to secure and manage a DSCR loan for your investment property. With the right preparation, lender selection, and management strategy, you’re now equipped to take advantage of DSCR loans opportunities. Leap and make your real estate investment dreams a reality.

Frequently Asked Questions

What is a DSCR loan and who is it best suited for?

A DSCR loan is best suited for self-employed individuals or those with irregular income, as it focuses on the cash flow of an investment property rather than personal income. It’s a type of mortgage ideal for such situations.

How is the DSCR calculated for loan qualification?

To calculate the DSCR for loan qualification, divide the gross rental income of the property by its total housing payment, including all relevant costs like taxes and insurance.

What are the minimum credit score and down payment requirements for a DSCR loan in Oregon?

To qualify for a DSCR loan in Oregon, you will generally need a credit score of 680, although some lenders may accept as low as 600, and a minimum down payment of 20%. Meeting these requirements is crucial for securing this type of loan.

How long does the approval process for a DSCR loan take?

The approval process for a DSCR loan typically takes 30 to 45 days, but providing all required documentation promptly can expedite the process.

Can I refinance my DSCR loan to get a better interest rate?

Absolutely. Investors frequently refinance DSCR loans to obtain lower interest rates, extend loan terms, or access cash-out options for property improvements or other investments. It’s a common strategy to improve their financial position.

Ready for More Great Tips and Information? Join Our Email List Today!